(Editor’s Note: The figures cited in this report have been converted from Euro to U.S. dollars using the exchange rate of September 25, 2007, when this report was released.)

Shortly before the Marmomacc exhibition in Verona, Italy, this past October, the Verona Chamber of Commerce released a report of Istat data for the first half of 2007 with regard to Italian natural stone import and export statistics. And for the first time in several years, the results were quite positive, with increases in a range of export and import categories.

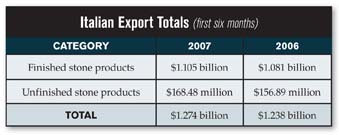

Analysis indicates that national exports of marble and granite - both unhewn (blocks and slabs) and processed (finished products) - came to $1.274 billion, compared to $1.238 billion in the first half of 2006 (+2.8%), while imports settled at $436.25 million, compared to $426.71 million in the same period in 2006 (+2.4%).

Closer examination of the figures reveals that exports of unhewn materials (blocks and semi-finished goods) came to $168.48 million in the first six months this year, compared to $156.89 million in the first half of 2006 (+7.4%). On the other hand, imports of unfinished material were stable at $337.99 million for the first six months of 2007 - practically matching the same total over the same period in 2006.

With regard to processed materials (finished products), exports in the first half of 2007 were worth $1.105 billion, compared to $1.081 billion a year earlier (+2.1%). Imports of finished products reached $99.06 million, compared to $88.72 million last year (+11.7%).

Export targets

The main export markets for Italy are still the U.S. and Germany, taking more than 40% of Italian exports. However, the German market is not growing, and the U.S. market has suffered distinct setbacks.During the first half of 2007, the American market imported stone materials worth $348.58 million, compared to $384.14 million in the same period in 2006. Of these totals, finished products exported from Italy to the U.S. totalled $339.54 for the first six months of 2007, compared to $370.75 million during the same period a year earlier (-8.4%).

Italian stone exports to Germany reached a total of $147.71 million for the first half of 2007, compared to $148.42 million during the same period a year earlier. Meanwhile, exports of finished products to Germany reached a total of $139.07 million in 2007, a decrease of 0.5% when compared to the previous year’s total of $139.77 million.

According to the report, the stone sector is being driven by exports within Europe - including “old” and “new” European nations. Exports within Europe grew 6%, compared to 2.1% on a world scale.

Exports have also been solid in countries where the “Made in Italy” stamp has always been in great demand. This is confirmed by trade with the United Arab Emirates, which imported $46.72 million worth of finished stone products from Italy during the first half of 2007, an increase of 20% from 2006’s first-half total of $38.72 million. In this market, natural stone products have been used in “fairy tale buildings in an impressive range of applications, flooring/paving, bathroom tops, luxury cladding, etc.,” according to the report.

On the other hand, exports to Saudi Arabia reached $27.14 million for the first half of 2007, compared to $32.06 a year earlier (-19.5%). Kuwait and Qatar also fell back.

The two new locomotives in the world economy - China and India - have achieved growth. Italian stone exports to China came to $36.03 million for the first half of 2007, against $27.20 million last year (+23%). Meanwhile, the figures for India came to $19.40 million, compared to $15.91 (+18%).

Returning to the “Old Continent,” there were increases in exports to Switzerland - $66.56 million against $61.19 million (+8%) - and the United Kingdom - $45.77 millon compared to $41.66 million (+9%). Exports to France were stable at $48.24 million compared to $48.36 million (-0.25%).

The performance of Italian stone materials in Russia was also solid, with exports in the first half of 2007 reaching $29.54 million, up from $23.53 million a year earlier (+20%). Positive trends were also noted in Spain, Croatia, Poland and Northern Europe (Belgium and Holland).

Even in Morocco, exports of finished stone products were on the rise, reaching a total of $13.06 million for the first half of 2007, against $8.08 million a year earlier (+38%).

Finally, the report made special mention of exports to Australia, which had a total value of $16.72 million for the first half of 2007, compared to $14.57 million a year earlier (+11%).

Import developments

Imports of stone into Italy were highlighted by finished products from China, which rose by 12% for the first half of 2007 - $29.99 million against $25.90 million a year earlier. Imports of finished products from India also grew by 12% - $11.78 million against $10.29 million.India is still the main supplier to Italian companies of unfinished material (blocks) - having reached a value of $78.03 million in the first half of 2007, up 16% from last year’s figure of $65.15 million.

Imports from Egypt also grew to $16.88 million for the first half of 2007, against $14.07 last year (+16%).

On the other hand, there was a drop in imports of unfinished material from Brazil during the first half of 2007 - $58.05 million against $70.15 million (-20%). This was also true of Norway, which exported $16.87 million worth of blocks during the first six months of 2007 versus $20.25 million (-20%) a year earlier, and Zimbabwe - $16.56 million against $20.71 million (-16.5%).

Imports from South Africa were stable, with Italy purchasing $32.70 million worth of blocks during the first half of 2007, a slight 0.8% drop from the previous year.

In general, the first quarter of 2007 achieved strong growth in the field, followed by a drop in the second quarter. This was especially true in the finished product sector, where competition by so-called “emerging countries” - now well-established in the international sector - is increasingly stiff.

In conclusion, the report reiterated that Italy remains one of the leading stone producers in the world - with 11,000 industrial companies and small businesses, more than 55,000 employees in the sector and an overall value of about $5.64 billion.