The Brazilian Sector

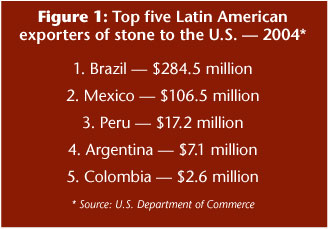

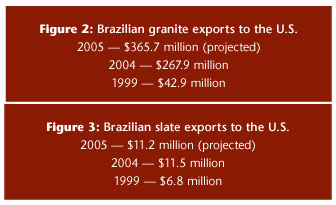

Brazilian stone exports to the U.S. have reached record highs, with a total value of $284.5 million in 2004 (the most recent annual total released by the U.S. Department of Commerce). That total is over five times greater than 1999's figure of $51.5 million, and it signifies Brazil's emergence as a world leader in stone production.Brazil's stone exports to the U.S. have largely been granite - particularly granite slabs - as it exported $267.9 million worth of granite to the U.S. in 2004, placing it a close second behind Italy's total of $277.9 million. However, over the first eight months of 2005, Brazil's granite monthly export totals were consistently higher than those from Italy. Through September 2005, Brazil exported $274.25 worth of granite to the U.S. (projecting to $365.7 for the entire year, a rise of greater than 33% over 2004). Italy's granite exports to the U.S. through August of 2005 totaled $206.83 million (projecting to $275.8 million for the entire year, similar to the 2004 figure). It should be noted, however, that Italy remains far and away the leading exporter of natural stone to the U.S., since it is also the top exporter of marble to the U.S. (including travertine), and it is also among the leaders in exports of slate and other materials.

The exploding popularity of granite kitchen countertops in the U.S. market has clearly been the leading driver for Brazil's success in the granite slab sector, and the development of their stoneworking plants reflects this trend. Large-scale operations are continually developing for slab production, with new gangsaws, polishing lines and resin-treatment lines - following the rapidly growing demand for resin-treated slabs within the U.S. marketplace.

In other stone material sectors, Brazil has become the third-highest exporter of slate to the U.S., reaching a total of $11.5 million in 2004, up from $6.8 million five years earlier. Through September of 2005, Brazil exported $8.4 million worth of slate to the U.S., projecting to a year-end total of $11.2 million.

According to Milanez & Milaneze, which organizes the International Marble & Granite Fair in Vitoria, Brazil, total world exports of Brazilian stone reached over $600 million in 2004. Of this total, the State of Espirito Santo, where much of the granite is quarried and processed, exported $337.4 million worth of stone to the world market. And according to Milanez & Milaneze, eight of Brazil's top 10 stone exporters are located in Espirito Santo.

Overall, Milanez & Milaneze reports that Brazil produces 6.4 million tons of ornamental stone per year, and the sector employs more than 125,000 jobs.

The Mexican Sector

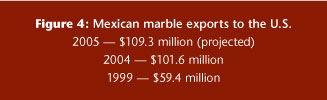

On the marble side of the equation, Mexico is clearly the leading U.S. supplier from Latin America, having exported $106.5 million worth of stone to America in 2004. The vast majority of these imports -- $101.6 million -- was comprised of marble, limestone and travertine to the U.S. (It should be noted that U.S. Customs does not distinguish marble imports from limestone and travertine imports, placing all three materials under the broad classification of “calcareous stone.â€)Through September of 2005, exports of marble from Mexico to the U.S. totaled $82 million, which projects to a year-end total of $109.3 million, an increase of nearly 8% over 2004's total. Although this growth figure is not as large as the figures seen in Brazil, it is significant because Mexican stone products have faced stiff competition from other exporting nations selling at a cheaper price. The growth of Mexican marble exports despite increased competition is testament to the quality and reputation of products being exported from Mexico.

Looking at this growth from an historical perspective, Mexican marble exports to the U.S. in 1999 reached a total of only $59.4 million - just over half of this year's projected total.

Unlike the granite market, which is based largely on slab sales, much of the marble exported from Mexico to the U.S. is shipped in tile form. The tan/beige tone of Mexican marble, limestone and travertine has been popular with designers for years, and the stone's aesthetics with a honed or tumbled finish fit well with the “Old World†design trend that has been in place for more than a decade.

Other Major Latin American Producers

Among other stone-producing nations in Latin America, the top exporters to the U.S. in 2004 were Peru ($17.2 million), Argentina ($7.1 million) and Colombia ($2.6 million).Within Peru, the vast majority of exports are marble ($16.9), including colored marble varieties as well as warm, earth-toned varieties of limestone and travertine. Looking at the production of some major Peruvian stone suppliers, the bulk of the marble shipped to the U.S. is in tile format, although some slabs and cut-to-size pieces are also exported to America.

In Argentina, 2004 exports were a mix of marble ($4.2 million) and granite ($2.6 million), along with small quantities of other stones. Some Argentina-based suppliers have attempted to penetrate the American market on a larger scale, and this has helped the country's stone exports to the U.S grow from $2 million in 1999 to $7.1 million in 2004. However, the domestic economic uncertainties of the past - and the fluctuating popularity of Argentina's native stone varieties - have hindered growth to some degree. Recent financial reports show that Argentina's domestic economy has improved, so it is conceivable that stone producers there could increase their efforts in targeting the U.S. market.

Colombia's 2004 stone export total of $2.6 million to the U.S. is a marked improvement over 1999, when exports to the U.S. totaled just over $700,000. Moreover, certain stone producers in Colombia have upgraded their facilities with an eye on the American market, offering products such as tiles in different formats, intricate stone mosaics and carved stone sinks.