Forecast for 2008

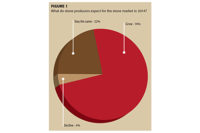

Speaking on the coming year, only a small quantity of respondents (15.7%) expected the market to decline in 2008. Approximately one-third of fabricators (36.7%) said that the market would hold steady this year, and perhaps most encouraging, nearly half of the fabricators polled (47.6%) felt the market would increase in 2008.On the negative side, fabricators who predicted a decline in business in 2008 felt that the impact would be fairly significant. A total of 94% of these respondents said the decline would be greater than 10%, and the majority of those predicting a decline (60%) felt that the drop-off would be greater than 15%. Overwhelmingly, fabricators cited the sagging housing market and general economic slump as the reasons for their less-than-positive outlook. "We do not believe we will see relief from the current economic downturn until 2009," stated one fabricator. Increased competition from new stone fabricators was another major factor cited by respondents. Summing up the feelings of several fabricators who took part in the poll, one respondent stated: "There are just too many fabricators springing up."

Meanwhile, fabricators calling for growth this year are also expecting fairly major changes. A total of 83% of those expecting growth said it would be more than 10%, and 37.9% felt that the jump would be over 15%.

The stone fabricators who are predicting growth in 2008 also offered several common factors for their optimism. Many respondents pointed to the affordability of stone as well as market demand and consumer awareness. "Stone is an excellent product that is becoming more affordable," stated one fabricator, while another pointed out: "Every person with a Formica top is a prospective client."

Several fabricators specifically stated that "granite has become a standard" for today's kitchen projects. "[Consumer] magazines and design shows all feature granite and other natural stones," explained one survey participant. Another stated. "Stone is even the standard in lower-priced homes."

The sustainability of natural stone was also a factor cited by many fabricators, with statements such as: "Green design embraces stone. People know that their stone will never have to be replaced."

Long-term optimism

Looking at the next five to 10 years, fabricators were extremely positive in their outlook for the industry. A total of 81.3% of those polled said that the industry would grow over this period, while 13.9% said that it would hold steady. Less than one out of 20 fabricators polled (4.8%) said that the industry would decline over the next five to 10 years.Forecasters of long-term growth within the stone industry expect substantial increases, as 89.4% said business will rise greater than 10%. More than half (53.8%) said that growth would be greater than 15%, and over one-quarter (26.3%) said that the rise would be more than 25%.

Once again, participants in the poll pointed to the affordability of stone and the growing popularity and demand as reasons for long-term optimism. "Applications using stone are still being discovered by both professionals and homeowners," stated one fabricator. Also contributing to long-term growth, fabricators who took part in the poll stated that the slowdown in housing starts does not necessarily affect the demand for natural stone in residential applications. "Remodeling will continue, and many stone markets in America are yet to be discovered," stated one survey participant. Echoing this thought, another stated, "Work from new construction will be slow, but remodeling work will pick up as folks decide to stay in their current homes."

Even in the area of new construction, fabricators showed optimism for the next five to 10 years. Many specifically said that the housing market would rebound, and they attributed the current slump to traditional economic cycles. "Construction may be at a standstill now, but it will still grow over the next five years," said one survey participant. Yet another stated: "In seven years, the construction business is going to be flourishing."

Looking back on 2007

Although it is generally agreed upon that the first half of last year was stronger than the second half, the majority of fabricators (56.3%) saw their business increase overall for 2007 as compared to 2006.Also quite positive, the increases noted by respondents over the past year were sizeable. More than one-third of the fabricators who noted an increase (36%) said that their business grew by a factor of greater than 20% last year. Another 18.6% said that their business increased between 16 and 20% in 2007.

On the negative side, more than one out of five fabricators (21.1%) said that they saw their business decline in 2007. And the decreases were noteworthy, as more than one-third of those companies that noted a drop-off (34.4%) said that the decrease was over 20%. An additional 20.3% of those who saw a decline said that business fell over somewhere between 16 and 20% in 2007.

Examining specific sales figures for 2007, well over half of the fabricators polled (60.2%) said that their gross annual sales were $1 million or more, and the vast majority (81%) reported sales of at least $500,000 for the year. There were also some fairly major players participating in the survey, as 12.5% of respondents reported sales of more than $5 million in 2008.

Facing challenges

Speaking on specific obstacles in the marketplace, the fabricators polled were split on whether or not they were affected by new faces in the sector. A total of 56.4% of survey respondents said that new stone fabricators had no direct, negative impact on their business during 2007, while the remaining 43.6% of those polled did feel the effects of new competition.Those who felt they were hurt by increased competition felt that the losses were fairly sizeable -- 11.9% reported a decline of more than 20%, and an additional 23% said that the drop-off was 11 to 20%.

On a more positive note, only a small portion of the fabricators (13.3%) said that they were hurt by increased competition from solid surface products such as DuPont Corian and Avonite, among others. And even those who said they were impacted felt that the effect was minimal, with 64.3% of those noting a decline reporting that the drop-off in business was only 1 to 5%.

When asked to compare a range of obstacles facing today's fabricators, the highest percentage of respondents felt that the decline in the housing market was the single greatest challenge today (42.4%). This was followed by increased competition from low-end fabricators (37.5%), the devaluation of the U.S. dollar (7.2%), competition from manmade products (6.4%) and personnel issues (6.4%).

Investments for 2008

The relatively optimistic view of fabricators for the coming year can be seen in their planned investments. The majority of those polled (66.1%) said they will increase their investments in equipment this year, and nearly a third (31.4%) will be upgrading their overall fabricating facilities. Many fabricators are also planning to invest more money in their workforce, as 36.6% said they would be increasing their investment in personnel in 2008.Given the increased competition in the stone fabrication sector, it is not surprising that over half of fabricators polled (51.2%) said they are increasing their investment in marketing for 2008. Additionally, 39.1% of the survey participants said they would be investing more in their showroom facilities this year.

Looking at specific equipment investments, fabricators are planning to buy a range of large-scale stoneworking machines in 2008. Topping the list in terms of cost, a total of 14.8% of fabricators said they would be investing in CNC stoneworking centers in 2008. And while this total represents only one out of seven fabricators, it is fairly important when considering that the mean dollar amount to be spent on CNC technology is over $203,500 dollars.

The market for bridge saws also seems to be changing. Even though the percentage of fabricators planning to invest in this machinery is similar to years past -- one out of six (16.6%) -- the amount of money being invested has grown quite a bit. This year, the mean dollar amount being spent on bridge saws is over $85,000 -- a jump of 10% over the figure cited last year and an increase of 56% over the figure cited in 2006. This rise is clearly reflective of the fact that bridge sawing machinery has become more sophisticated over the past few years, and fabricators are now embracing this enhanced technology.

Another major area of investment will be polishing machines. Nearly one-third of survey participants (32.5%) said they would be investing in this equipment, with a mean dollar amount of over $43,500 being spent.

With an eye on safety and efficiency, investment in material handling and transportation equipment will also be significant in 2008. Perhaps concerned by the number of injuries and even fatalities due to poor slab handling, a total of 41.3% of fabricators polled said they would increasing their investments in this area, spending a mean dollar amount of nearly $25,000. In terms of larger-scale handling investments, 15.5% of respondents said they would be purchasing cranes in 2008, spending a mean dollar amount of nearly $32,000.

Looking at some relatively new technology introductions to the stone fabrication sector, a total of 12.4% of survey participants said they would be investing in digital/electronic templating systems in 2008. Considering that very few (if any) fabricators considered this technology five years ago, the fact that one out of eight respondents will be spending a mean dollar amount of nearly $17,500 in this area is fairly significant. It demonstrates that fabricators are not simply considering this technology, but they are now prepared to spend money.

Also of note, over one-fifth of the fabricators polled (21.6%) said that they would be investing in management software in 2008, spending a mean dollar amount of almost $12,000.

Additionally, 9.5% of fabricators polled said they would be investing in equipment that falls into the "other" category. These include water treatment systems, combination bridge saw/waterjets and machines specifically designed for sink cut-outs.

As in previous years, hand tools were the most prevalent common area of investment, with 82.7% of respondents indicating that they will invest in this area in 2008. However, with the mean investment among respondents totaling under $9,000 for hand tools, this will not have a huge impact within the industry.

Overall, capital outlay budgeted for 2008 is moderate, which is expected when considering the relatively small size of the typical fabrication shop. More than half of respondents (53.9%) are planning to outlay less than $250,000 in 2008, with another 29.5% planning to invest $250,000 to $499,999 this year. However, nearly one out of six fabricators surveyed are planning major investments during 2008, as 16.7% said they would be investing more than $500,000 million in their business this year.

Survey demographics

Consistent with previous surveys conducted by BNP Media (Stone World'sparent company), participants in this most recent study were relatively small in size, although the breakdown for each classification was fairly similar. A total of 27.4% of respondents had one to five employees; 27.1% had six to 10 employees; 24.7% had 11 to 25 employees; and 20.8% had more than 25 employees.Looking at the experience of the fabricators polled, this survey was answered by a healthy mix of industry veterans and companies that are relatively new to the trade. A total of 31.6% said they were in business for more than 20 years; 23.9% have 10 to 19 years experience; 21.5% have five to nine years of experience; and 23% have been in business less than five years.