Over the past few years, the stone industry in the U.S. has been growing at an unprecedented rate. And while the majority of fabricators polled in this year’sStone Worldsurvey predict that growth will continue, their optimism has not been as overwhelming as in recent years.

Of those who responded to theStone Worldsurvey, which was sent primarily to stone fabricators, 58.2% said they expect the stone market to increase in 2007. Last year at this time, 75% of fabricators predicted an increase for the upcoming year.

It is important to note that the fabricators predicting an increase in 2007 felt growth would be substantial. A total of 84% predicted that business would rise over 10%, and 41% said growth would be more than 16% in 2007. Moreover, about one out of eight fabricators (12.9%) said business would increase by more than 25% in the coming year.

Respondents offered several specific reasons for their optimism. They pointed to market trends as well as overall building and construction growth in their area, and they also cited continued remodeling activity and a demand for stone in particular. These factors, they felt, would offset the decline in the real estate market. “Although there is a slowdown in the housing market, stone is taking over for other types of surfaces,” stated one respondent. Another fabricator noted that even though the housing market may have stopped its incredible growth, it is still at a high level. “Although existing home sales have declined this year, they are still at an all-time high.”

Among the few respondents who predicted their business to decrease in 2007, the majority (55.6%) felt the decline would be between 10 and 20%, although over one-third (35.6%) felt that business would fall off more than 20% this year. These respondents cited the housing market slowdown as well as overall economic conditions as their reasons for the decline.

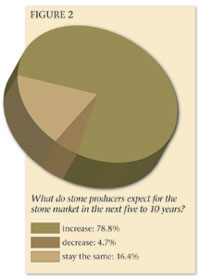

The next decade

Stone fabricators were also asked for their expectations for the stone industry over the next five to 10 years, and they were even more optimistic over the long term. A total of 78.8% predicted growth, and 16.4% said business would hold firm over that time, with only 4.7% predicting a decline.Once again, those expecting an increase felt it would be considerable, with more than half (54.6%) saying it would be more than 20%. In fact, over one-quarter of respondents (26.6%) feel that their business would grow by 30% or more over the next five to 10 years.

Many of those predicting that the market would remain the same over the next five to 10 years felt that the real estate market “has peaked” and that business simply has to “flatten out” after such a dramatic upward trend. “A certain plateau should be expected in three to seven years,” stated one fabricator, while another wrote, “I think the housing boom will stabilize.”

Fabricators who predicted a decline felt that “other trends would develop” in terms of consumer preferences, with one stating, “stone is a fashion that comes and goes.”

Profits over the past year

Fabricators polled byStone Worldwere also asked to compare the performance of their business in 2006 as compared to 2005, and the response was very favorable. Over two-thirds of those polled (69%) said their business increased last year, with 23.8% stating that sales stayed the same and 7.3% reporting a decrease.Gauging the size that the market increased last year, the majority of fabricators (58.1%) said that their business grew by a factor of 16% or more in 2006, and 39.7% said it increased by more than 20%.

Looking at specific sales figures, over half of the fabricators polled (53.9%) said their gross annual sales were $1 million or more in 2006. Nearly three-quarters (73%) saw sales of greater than $500,000 for the year. Some fairly major players also participated in the survey, as 8.4% of respondents said their annual sales were between $2.5 million and $5 million, and another 13.2% said their sales were $5 million or more in 2006.

Industry challenges

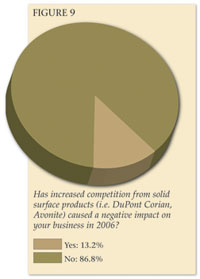

Despite the success of the U.S. stone industry, the trade also faces some obstacles, and competition is at the top of the list. Stone industry members are not only facing competition from manmade products such as DuPont Corian or Avonite, but also from new fabricators cropping up in their region.In terms of competition from manmade products, fabricators are largely unaffected, according to the survey. The large majority of respondents (86.8%) said these solid surface products have had no negative impact on their business. Even the few respondents who did say that solid surface products affected their business shrugged off the impact as minimal, as 85.9% said the loss was under 10% and the majority (57.7%) said it was less than 5%.

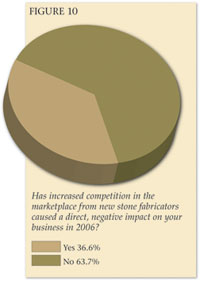

Of course, new competition in stone fabrication is not only coming from small start-up shops, but from large-scale solid surface and laminate fabricators who move into the stone industry. Several of the fabricators polled cited these operations as damaging to the industry as a whole. “Price cutting and poor quality by large automated fabricators is damaging the industry far more than demand for solid surface,” stated one respondent. “Manufacturers do not know what saturation is. Too many people competing for a limited market is not good.”

Still, the majority of fabricators (63.7%) felt that new competition had no direct impact on their business during 2006. Many respondents felt that maintaining high quality standards would protect them from increased competition. “If you do good work, you will have work,” said one respondent, while another said, “Although competition puts pressure on pricing, more people are looking for quality service.”

Investments in 2007

After a relatively successful 2006 and with cautious optimism for the future, many stoneworking firms in the U.S. are planning to increase investments in their business. Fabricators will be spending money on equipment, personnel, marketing and facilities this year, as they work towards long-term growth while also separating themselves from increased competition.With an eye on increasing quality and efficiency in the shop, a total of 70.8% of fabricators polled said they will increase their investments in equipment this year, and a significant number will also be upgrading their overall fabricating facilities (34.5%). As business increases, so does the need for an increased labor force, and this is reflected by the fact that 43.6% of fabricators said they will invest more in personnel (38%) in 2007.

Realizing the increased interaction with consumers, many fabricators said they would increase their investments in marketing (42.7%) and showroom facilities (32.1%) in 2007. Also, with more and more stone choices in the marketplace, 34.2% said they would be increasing their investment in stock this coming year.

As usual, the bulk of equipment investments will be made for the kitchen countertop sector, and many fabricators are planning to purchase some big ticket items. Over one-third of the fabricators polled (36.5%) said they would be investing in polishing machines, with a mean dollar amount of over $48,500.

And given the increased volume of business, close to half of the survey respondents (43.3%) said they would be investing in material handling and transportation equipment. The mean dollar amount to be spent in this area reached a total of over $27,500.

As in years past, approximately one out of five fabricators (20.5%) is planning to invest in bridge saws this year. However, the mean dollar amount to be spent (nearly $78,000) is much greater than last year’s figure of $55,000. This may well be a result of the more advanced bridge saws on the market today, which feature greater automation and versatility.

Fabricators are also investing in some of the relatively new introductions to the stone industry, such as management software (20.3% planning to invest a mean dollar amount of over $10,000) and digital/electronic templating (11% planning to invest a mean dollar amount of over $21,000).

Additionally, 10.4% of fabricators polled said they would be investing in equipment that falls into the “other” category. These investments also have a high price tag, with a mean dollar value of nearly $164,000. Investments in the “other” category include waterjet technology, water and air treatment systems and vehicles, among other items.

As usual, hand tools were the most prevalent common area of investment, with 87.5% of respondents indicating they will invest in this area in 2007. However, with the mean investment among respondents totaling just under $10,000 for hand tools, this is not expected to cause a huge impact for machinery suppliers.

The capital outlay budgeted for 2007 is once again moderate, which is not surprising considering the relatively small size of a typical fabrication shop. More than half of the fabricators polled (58.4%) are planning to outlay less than $250,000 in 2007, with another 22.6% planning to invest $250,000 to $499,999 this year. Playing on the “cautious” side of “cautious optimism,” less than one in 10 fabricators polled are planning major investments during 2007, as only 9.6% said they would be investing more than $1 million.

Survey demographics

Despite the influx of new companies in today’s marketplace, the participants inStone World’s survey were relatively well-established firms. A total of 74.2% of respondents have been in business for over five years, almost identical to the figures given over the past few years, and over half (54.3%) have been in operation for more than 10 years. The survey also included a fair amount of long-term industry veterans, as 28.8% of respondents have been in business for more than 20 years.In terms of company size, stoneworking firms in the U.S. remain relatively small, although the breakdown in number of employees is fairly close in each classification. A total of 25.8% of respondents had one to five employees; 21.9% had six to 10 employees; 28.6% had 11 to 25 employees; and 23.6% had more than 25 employees.