Given the rocky financial landscape that virtually all fabricators are facing these days, it makes sense that the results of this year’s annual U.S. stone fabricator survey received a very mixed reaction from respondents. On the positive side, the majority of respondents actually said their business stayed the same or increased during 2008. On the negative side, more than two out of five fabricators did see their business decline last year; moreover, the falloff was fairly significant (generally 11% or greater).

In the future, however, the mood is much more upbeat - particularly over the long term - as the vast majority of fabricators feel that the stone market will grow over the next five to 10 years.

The survey was conducted by the Market Research Department at BNP Media (Stone World’s parent company), and it polled a cross-section of fabricators across the U.S., including large and small firms as well as relatively new and well-established companies.

Predictions for 2009

Looking at the coming year, the opinions of fabricators truly ran the gamut. A total of 40.0% felt that business would decline in 2009, while 37.4% said that sales would stay the same. On a more positive note, more than one in five fabricators (22.6%) felt that business would increase in 2009.Fabricators who felt business would decline in 2009 widely varied as to how much the losses would actually be. While 25.0% said that they expected business to drop off by 20% or more, 36.7% felt that the decline would be less than 10%. Another sizeable portion of those polled (38.3%) felt that losses would be between 11 and 20%.

Overwhelmingly (and somewhat obviously), most fabricators predicting a decline in 2009 cited the economy and accompanying housing market declines as reasons for their bearish predictions. “We’re already down 20%, and the recession just started,” stated one fabricator.

Fabricators expecting growth gave a range of reasons for their feelings - including the inauguration of a new U.S. President, the cyclical nature of economics and the increasing popularity of granite overall as a building material. “Granite is still at the top of the list for home improvements,” stated one fabricator, with another adding, “Stone is now the standard in new homes, and a must-have for remodels.” Some companies also pointed to currently contracted work - particularly in the commercial sector - as a reason for optimism.

Long-Term Optimism

The outlook of fabricators over the next five to 10 years was much more positive. According to the Stone World survey, more than three out of four fabricators (75.8%) feel that the market for stone in the U.S. will grow over the next five to 10 years, another 14.7% felt the market would remain the same, and only 9.5% were predicting a decline.However, they were somewhat guarded in predicting a huge increase in sales. Only 38.3% of fabricators overall felt that growth would be 11% or more over the next five to 10 years. Representing the most optimistic sector, a little more than one out of seven fabricators (14.5%) predicted growth of 20% over the long-term.

Of the fabricators predicting a long-term decline in the market (representing less than one out of 10 respondents), most felt it would be due to a continued economical decline and potential competition from manmade materials.

Investments in 2009

Despite uncertainties in the market over the short term, fabricators are still planning to invest in their operations in 2009. The majority of those polled (57.0%) said they will increase their investments in equipment this year, and one out of four (25.0%) will spend money to upgrade the fabrication facility itself.In an effort to generate business during challenging, competitive times, over half of fabricators polled (52.5%) said they are increasing their investment in marketing for 2008. Additionally, 34.2% of the survey participants said they would be investing in showroom facilities this year.

For companies looking to add machinery, fabricators cited a range of large-scale stoneworking machines on their wish list for 2009. Topping the list in terms of cost, a total of 10.5% of fabricators said they would be investing in CNC stoneworking centers in 2009. Although this figure represents just more than one out of 10 fabricators, it is fairly significant when considering that the mean dollar amount to be spent on CNC technology is more than $186,000 dollars.

Another major area of investment will be polishing machines. More than one-quarter of survey participants (26.0%) said they would be investing in this equipment, with a mean dollar amount of over $65,000 being spent.

Fabricators are also investing in safety and efficiency, as 36.0% of survey respondents said they would be spending on material handling and transportation equipment during 2009. This investment comes with a fairly high price tag, as fabricators said they would spend a mean of nearly $35,000 for this technology in 2009.

A number of companies are also planning to continue investments in digital/electronic templating systems for 2009, with just about one out of 10 fabricators (9.7%) planning to invest a mean amount of over $27,000 in this technology in 2009.

Also of note, nearly one-fifth of the fabricators polled (17.4%) said that they would be investing in management software in 2009, spending a mean dollar amount of almost $12,000.

As in previous years, hand tools were the most prevalent common area of investment, with 85.3% of respondents indicating that they will invest in this area in 2009. However, with the mean investment among respondents totaling under $11,000 for hand tools, this will not have a huge impact within the industry.

Capital Outlay for 2009

Already moderate to begin with - considering the small size of the average fabrication shop - capital outlay among fabricators will likely be on the decline during 2009.Well more than half of respondents (72.1%) are planning to outlay less than $250,000 in 2009. (Last year, that total was 63.4%). Another 14.6% said they are planning to invest $250,000 to $499,999 this year, and only 13.3% were planning to invest more than $500,000.

Fabricators also pointed to specific spending cuts that they made during 2008, with 61.7% saying that they reduced spending on personnel during the year - by means of attrition when possible, and by layoffs when unavoidable. Fabricators also said they cut investments in stock (with 45.8% saying their reduced spending in this area), equipment (39.1%), marketing (29.6%) and facilities (20.6%) last year.

Results for 2008

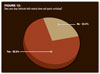

In addition to asking about the future, the Stone World survey asked fabricators to compare the business levels for 2008 as compared to 2007. Responses to this question were perhaps more positive than expected. While 43.1% of those surveyed said their business declined in 2008, another 18.4% said that sales held steady, and a surprising 38.5% actually said business grew in 2008. Of course, the real banking/credit industry collapses occurred during the second half of 2008, so many fabricators enjoyed their greatest success during the first six months of the year.Of companies that saw an increase in business, the gains varied quite a bit. A total of 17.3% said that the increase was only 1 to 5%,while 38.2% saw growth between 6 and 10%. However, there were some companies that saw solid growth in 2009. A total of 25.5% reported growth between 11 and 20%; and 19.1% reported growth of more than 20%.

Among fabricators that saw a decline in business, the losses were fairly significant. A total of 12.4% said that the decrease was between 1 and 5%,and an additional 25.6% lost between 6 and 10%. More noteworthy, another 25.6% percent of those noting a decline said the losses were between 11 and 20%, and an additional 36.4% reported declines of more than 20%.

Overall, fabricators were relatively split between companies doing more than $1 million in annual sales (51.8% and less than $1 million (48.2%). Broken down further, 27.9% said that sales were less than $500,000; 20.3% reported sales of $500,000 to $1 million; 32.8% reported sales of $1 million to $2.9 million; 9.3% reported sales of $3 million to $4.9 million; and 9.7% reported sales of over $5 million.

“The Great Radon Scareâ€

On a positive note, consumer fears regarding unsafe radon content in granite did not appear to have a major impact on the natural stone industry in 2008. Nearly three-quarters of fabricators (74.6%) said that fears regarding granite and radon had absolutely no effect on their business in 2008, and of the 25.4% who did see an effect, the vast majority said that declines were only between 1 and 5% overall.Moreover, even less fabricators felt that concerns over radon in granite would not be an issue in years to come, as an overwhelming majority of 88% of fabricators said there would be no long-term effect whatsoever.

Also of interest, a total of exactly two-thirds of fabricators (66.6%) said that they fabricate both natural stone and some form of quartz surfacing, while only one-third (33.4%) said they fabricate natural stone only.

Other Challenges in 2008

When asked about the greatest challenges facing fabricators in today’s marketplace, 43.7% said it was the decline in the housing market; 28.8% felt it was competition from low-end fabricators; and 24.6% said it was the banking/credit industry crisis. Just about no one felt it had to do with the devaluation of U.S. currency (2.6%) or the granite/radon scare (0.4%).Survey demographics

Consistent with previous Stone World fabricator surveys, participants in this most recent study were relatively small in size. A total of 29.6% of respondents had one to five employees; 25.9% had six to 10 employees; 26.3% had 11 to 25 employees; and 18.2% had more than 25 employees.

Looking at the experience of the fabricators polled, this survey was answered by a mix of industry veterans and companies that are relatively new to the trade. A total of 32.6% said they were in business for more than 20 years; 24.6% have 10 to 19 years experience; 25.6% have five to nine years of experience; and 17.3% have been in business less than five years.