|

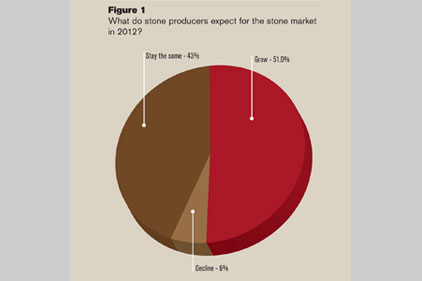

| Figure 1 Click to enlarge |

These are the results of a survey conducted by the Market Research Department at BNP Media (Stone World’s parent company), and it polled fabricators across the U.S., including large and small firms as well as relatively new and well-established companies.

Predictions for 2012

|

| Figure 2 Click to enlarge image |

Speaking on the coming year, stone fabricators expressed optimism for the second straight year. A total of 51% of respondents said the stone market will increase in 2012; 43% said it would stay the same; only 6% said there would be further declines.

Of the fabricators who expect growth this year, the majority (67%) said that increases would be greater than 6%. Moreover, 17% of those expecting an increase are predicting growth of 11% or more.

|

| Figure 3 Clcik here to enlarge image |

When asked why they were optimistic for 2012, fabricators pointed to their own experiences over the course of 2011, with many citing increased walk-in traffic and customer inquiries. “[We have seen] growth over the past six months,” stated one respondent, with another basing his optimism on “jobs that are already staged for 2012 now.”

“We have grown our business constantly for four years with no slow-down,” stated yet another fabricator. “Coupled with housing prices this low and forecasted to go even lower, I see no slump in the future for us.”

|

| Figure 4 Click here to enlarge image |

Many other fabricators pointed to improving economic conditions in general. “In my view, the market reached its bottom in 2009-2010, and this year, I have seen more confidence in customers that the worst is over,” said one fabricator. “That has led them to start spending again.”

With so much of the current countertop work taking place in the residential remodeling sector, it comes as no surprise that many fabricators increased remodel activity as a reason for optimism. Ironically, some of those polled said that the economic slowdown is causing more homeowners to remodel their properties. “People are spending more money on makeovers in kitchen and bath because they can’t afford a new place,” stated one fabricator, with another echoing this sentiment. “We have seen that more people are remodeling their homes, specifically their kitchens, due to housing issues. We have seen a larger shift to replacement over new construction.”

For those predicting that the market will stay the same in 2011, most respondents said that the housing market that is “stuck in a neutral position.” In fact, a large number of these fabricators stated something along the lines of: “I do not expect our sales to decline, but I do not see them improving, either.”

|

| Figure 5 Click here to enlarge image |

Long-term confidence

Looking at the next five to 10 years, fabricators who participated in the Stone World survey expressed even greater confidence. The vast majority of fabricators (83%) predicted that the market for stone will increase over the next five to 10 years, with another 17% stating that it would remain stable. Almost no one (1%) predicted a decline.

|

| Figure 6 Click here to enlarge image |

But even while most fabricators said that the worst is behind us, they say that the road to recovery will be a long one. Only one-quarter of the fabricators calling for long-term growth (25%) said that increases would be more than 11%. Exactly half of the respondents (50%) felt the increases would be somewhere between 6 to 10%.

When asked about the reasons for long-term optimism, fabricators again pointed to a more positive overall economic picture. “I’d like to believe that we are experiencing the low point in our industry now; it has to get better from here,” stated one fabricator, a sentiment that was repeated several times.

|

| Figure 7 Click here to enlarge image |

Many fabricators also pointed to consumer demand for natural stone, particularly in the residential sector. “[The] stone industry has gotten to the point where it is most affordable,” said one fabricator. “In many cases, granite countertops are becoming a standard.”

This philosophy was repeated by several other fabricators, with statements such as: “New innovative methods for the use and marketing of stone, along with growing population; stone has become a ‘must have’ as opposed to a ‘would like to have,’ “ and “More and more consumers are expecting stone countertops; prices have declined enough to make this an affordable luxury for most middle-class.”

Fabricators again pointed to the remodeling market as well, with statements such as “I think people have been waiting to remodel or upgrade over the past few years, and I believe that when things finally start to improve steadily, there will be a surge of business as people begin to follow through on their plans to remodel and upgrade.”

|

| Figure 8 Click here to enlarge image |

Investments planned for 2012

After several years of cutting spending on their operations, it appears that many fabricators are curtailing these cuts and they are planning to invest for the future. For example, one in four fabricators (25%) said that they did not make any spending cuts in 2011 (in 2010, that figure was 16%). Whether it was personnel, equipment, stock or facilities, cuts in 2011 were significantly down from the previous year.

Looking at planned investments for 2012, more than half (56%) said they would be spending on equipment this year — a slight increase from last year’s figure of 52%, although it seems that more large-scale investments are on the horizon.

Fabricators also said that they are planning investments in marketing (47%), personnel (36%), stock (32%) and showrooms (31%).

|

| Figure 9 Click here to enlarge image |

Speaking on specific equipment choices, hand tools were once again mentioned by most fabricators (72%), and they expect to spend a mean total of $6,309 in this area.

In terms of large-scale investments, the percentage of fabricators planning to purchase major machines seems to be on the rise.

More than one out of six fabricators (17%) said that they would be investing in a CNC stoneworking center this year, and they expect to be spending a mean dollar amount of $175,000.

An even higher mean value was placed on waterjet technology, with 7% of the fabricators polled expecting to spend $187,500 on this equipment this coming year.

Given the increased emphasis on shop safety, 37.7% of respondents said they would be investing in material handling technology this year, with a mean value of $24,630.

|

| Figure 10 Click here to enlarge image |

Also, perhaps due to increased consumer popularity of textured surface finishes, a total of 34% of fabricators said they would be investing in polishing equipment, spending a mean dollar amount of $19,807.

Looking back at 2011

In addition to all of the other factors for optimism in 2012, fabricators cited their relative success in 2011. The Stone World survey asked fabricators to compare their business levels for 2011 to 2010.

|

| Figure 11 Click here to enlarge image |

Responses to this question this year were much more positive than they have been for several years. According to the survey, 56% of fabricators saw their business grow during 2011. A year earlier, only 30% said they saw growth.

Meanwhile, 25% of respondents said that business held steady in 2011, and only 19% of those polled said that business declined for the year. For comparison, 37% of those polled for 2010 said they say a decline and 33% said that business stayed the same.

Also encouraging, the fabricators that said business increased said that the gains were significant. A total of 43% of fabricators said that growth was more than 11%, and another 13% cited growth of more than 20%.

|

| Figure 12 Click here to enlarge image |

Overall, most of the stone fabricators who participated in the survey (84%) saw less than $3 million in annual sales. A total of 33% reported sales of under $500,000; 15% said sales ranged from $500,000 to $1 million; another 37% reported sales of $1 million to $2.9 million; 7% recorded sales of $3 million to $4.99 million; and 9% had a sales total of more than $5 million.

|

| Figure 13 Click here to enlarge image |

When asked to compare today’s business climate to that of 12 months ago, 38% said that conditions were better, 24% said they were worse, and 39% said they were about the same.

Speaking on the greatest challenges in today’s marketplace, the greatest percentage of fabricators cited competition from low-end fabricators (35%), followed by declines in the housing market (27%), smaller margins (26%) and the devaluation of U.S. currency (6%).

|

| Figure 14 Click here to enlarge image |

Survey demographics

Historically, respondents to the Stone World fabricator survey were relatively small in size, and this year was no exception. A total of 33% of respondents had one to five employees; 24% had six to 10 employees; 28% had 11 to 25 employees; 7% had 26 to 40 employees, and 7% had more than 40 employees.

|

| Figure 15 Click here to enlarge image |

|

| Figure 16 Click here to enlarge image |

When asked about the amount of time they were in business, responses varied, but it seems there are less “new” companies than in the past. A total of 12% said they have been in business for five years or less (down from 16% a year ago), 29% have been in business for six to 10 years; 21% have been in business for 11 to 15 years; 11% said they’ve been in business for 16 to 20 years; 22% have been in business for 21 to 45 years; and 5% have been in business more than 45 years.

|

Nearly half of U.S. fabricators cite “Green Practices” |

|

At a time when it seems the entire building industry is citing “Green” as an essential element of their work, it would appear that the stone fabrication sector is finally catching up. As part of this year’s Stone World fabricator survey, we asked whether companies were promoting “green” or “sustainability/life-cycle” practices in their sales and marketing efforts. Nearly half of those polled (48%) said yes, and they cited a range of factors and practices that they promoted: Inherent green qualities of natural stone • “We are making the case that there is nothing more green than natural stone and that the industry is working at each stage of the process to document it.”

• “Natural stone is a ‘green’ building product, and the ‘end-all’ to the remodel cycle.”

• “We especially talk about stone being quarried within 500 miles. These achieve both sustainability and carbon footprint goals”

Promotion of recycling practices • “We are promoting our practices of recycling, including our water and waste materials.”

• “We are recycling our remnant materials into pavers.”

• “We recycle or donate old countertops, sinks, etc.”

• “We are explaining to customers our recycling systems for waste and water treatment systems. We are also showing them how our stone is being sent to a crushing firm for recycling to be used on roads, etc.”

• “[We promote] our relationship with Habitat for Humanity where we donate all drop and deconstruction material to the program. We have added green products to all of our marketing literature and increase promotion on our Web site.”

Use of recycled countertop materials • “We are promoting other green products, such as Eco by Cosentino, IceStone and other products.”

• “We are trying to handle more products [made] from recycled material.”

|